After an upside inflation surprise in October, it’s clear that peak inflation may still be ahead, possibly even pushing into 2022. While the Federal Reserve (Fed) maintains its position that elevated inflation will be transitory, we have yet to see progress. Below we look at five signs to watch for over the next several months that may signal that inflation may be near or at its peak.

The October reading for the Consumer Price Index (CPI), the most widely known measure of inflation, came with an upside surprise versus expectations on top of already elevated inflation concerns. The headline number came in at 0.9% for the month and 6.2% for the year, the highest reading since November 1990. The core reading (which excludes food and energy prices) rose 0.6% for the month and 4.6% for the year—the highest since August 1991.

Elevated inflation continues to be largely driven by pandemic-related dynamics—primarily supply chain challenges and tight labor markets combined with high demand as the global economy bounces back. The COVID-19 Delta variant has deepened those problems in unexpected ways, although we cautioned in the early days of the surge that further supply chain disruptions were likely. Calling inflation “transitory” has not really captured these inflation dynamics well. Elevated inflation will last as long as supply chain bottlenecks and hiring challenges remain in place. As those dynamics subside, we expect inflation to return to something close to 2%, but we believe that’s more of a 2023 conversation.

But market participants don’t need to wait until CPI is back under 3% to feel a sense of relief. It would be enough to know that we’re past the peak, something that might not happen until 2022. In fact, since markets are forward looking, it may be enough to have a “peek at the peak.” Here are five signs to watch for that peak inflation, if not immediately at hand, may be in the near future.

Supply Chains

Current inflationary pressure is primarily about supply chain disruptions, the inability to get product to market (whether because of labor and material shortages), the inability to maintain needed inventory, or logistical disruptions. Supply chains will heal over time—businesses have a strong profit incentive to address supply chain challenges. But there are structural constraints on how quickly progress takes place that businesses can’t control.

To take one high profile anecdotal example of supply chain disruptions and the impact of structural problems, there are currently over 100 container ships waiting to unload off the ports of Los Angeles and Long Beach, California. Before the pandemic, the worst backup was under 20. But the needed equipment, space, workers to accelerate progress simply isn’t available on demand.

Our best peek at how supply chains are doing may be purchasing managers’ index (PMI) readings. Supply-chain related readings from the Institute for Supply Management’s October release has shown some improvement in places, but disruptions remain elevated. The reading on order backlogs peaked in May, but at 63.6 remains well above its long-term median of just above 50 (above 50 indicates higher backlogs from the previous month). Likewise, supplier deliveries also peaked in May but has moved higher the last two months and was at a very elevated 75.6 in October. Readings in the mid to low 50s for both of these sub-indexes would probably be needed to indicate we were on the cusp of significant improvement to supply chain problems.

Housing and Rents

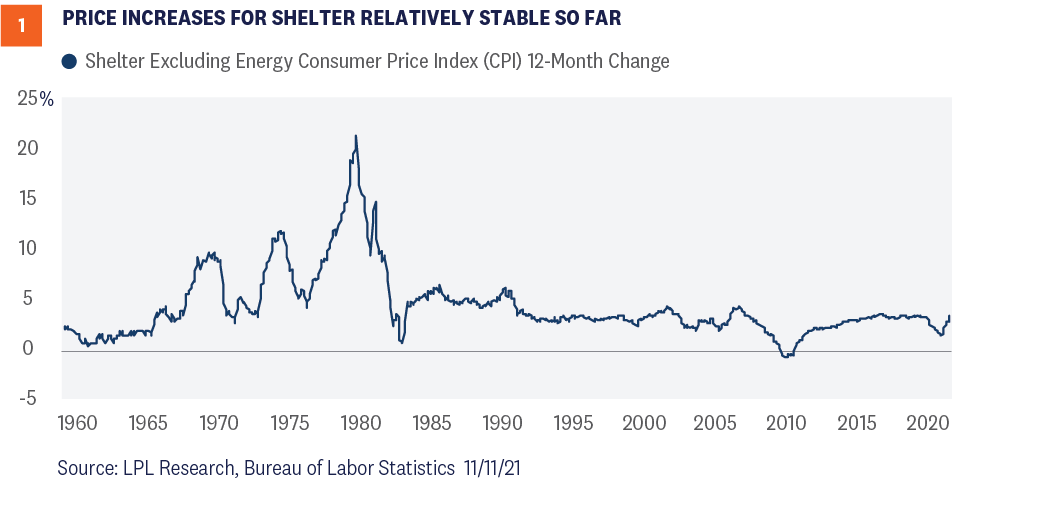

Shelter excluding energy costs, essentially housing costs and rents, makes up about 1/3 of CPI and just over 40% of core CPI (excluding food and energy). Costs for housing have picked up on a year-over-year basis but, unlike some other measures of inflation, it has not yet hit a high dating back to the 1990s [Figure 1]. In fact, current one-year housing inflation, at 3.5%, is lower than its 2019 peak. Nevertheless, housing costs have jumped the last three months and housing inflation is a concern—both because it represents such a high proportion of consumer spending and because it tends to be relatively sticky. Base effects (rolling low numbers off the one-year reading) will likely help push annual shelter inflation higher until April 2022, so looking at monthly numbers will be important. Consecutive monthly readings near 0.3% would be a good sign that housing costs have stabilized but, even at that level, the year-over-year number could continue to climb in the first several months of 2022.

Market Implied Inflation

Breakeven inflation rates, the difference between nominal Treasury yields (the number we usually hear about) and the yield for Treasury Inflation-Protected Securities (TIPS), can provide important information about inflation expectations. The breakeven inflation rate is the forward-looking reading of inflation at which TIPS would outperform similar maturity nominal Treasuries if inflation were to run higher. Because investors are willing to pay extra for a hedge against inflation, the breakeven rate tends to run higher than what true expectations may actually be.

The two-year breakeven began to climb in early October 2021 after holding roughly steady since early February, and currently sits around 3.3%. The Bloomberg-surveyed economists’ consensus for average inflation in 2022-2023 is 2.8%. Since higher near-term inflation expectations will roll off as we approach peak, a return of the two-year breakeven to around 2.75% would probably indicate we have passed the peak and a decline to below 3% could be an early signal the peak is coming.

Energy and Commodity Prices

Even though energy prices are volatile compared to overall price levels, for most people prices at the pump shape their perception of inflation more than anything else. Oil prices (West Texas Intermediate) have been climbing since October 2020 and now sit above $80 per barrel compared to a level that generally hovered closer to $60 for much of 2019. Global copper prices started climbing even earlier, beginning their advance in May 2020.

Both oil and copper prices can stay elevated for some time and it’s not as easy to target a particular signal that inflation may be settling down. Copper has already shown some stabilization since peaking in May and while base effects will be in play until April 2022, stability around current levels until the end of the year (or any sharp decline) would be a good signal inflation may soon peak. The picture on oil isn’t as clear. Oil maintained a range above current levels from 2011 to 2014, but CPI was still running under 2% for much of that period. If oil were to hover near $80 barrel into early 2022 with no significant advance, it would be a positive sign that inflation may be peaking, but we wouldn’t take it as a negative sign if it pressed higher.

Consumer Sentiment

Influenced by prices at the pump, consumer inflation expectations have skyrocketed. While not the best predictor of inflation, inflation expectations can have an effect on actual inflation and is monitored by the Fed. The Conference Board’s survey of consumer inflation expectations twelve months from now climbed to 7% in October. The New York Federal Reserve Bank’s consumer survey has also seen expectations spike, but to a more moderate (but still very elevated) 5.65% in October. Both of these numbers are well outside of norms.

For consumer expectations, just seeing the numbers begin to settle down would be enough to signal we were potentially near the peak. The Conference Board’s survey has a longer history, and typically spikes in expectations have been short lived. Current expectations have been over 6% for the last 11 months, with the most recent reading the highest. Expectations moving back below 6% would be an important signal we may be near or at the peak.

Conclusion

For market participants, the main inflation takeaway is how it might influence the Fed’s timeline for starting rate hikes. When evaluating that, we believe it’s important to factor in the Fed’s understanding of how a rate hike would impact the kind of inflation we’re dealing with. A rate hike usually helps to control inflation by slowing demand when an economy is overheating. But it can’t help ships unload containers more quickly or help address order backlogs. We still see the first rate hike likely coming in early 2023, especially if there are strong signals inflation has peaked. But if rising housing costs and consumer expectations make higher inflation stickier, we could see the first rate hike pulled into 2022. Whichever way it goes, you’ll know some of the key signals to watch for.

Barry Gilbert, PhD, CFA, Asset Allocation Strategist, LPL Financial

George Henry Smith, CFA, CAIA, CIPM Senior Analyst, LPL Financial

______________________________________________________________________________________________

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

U.S. Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet.

Please read the full Outlook 2021: Powering Forward publication for additional description and disclosure.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value