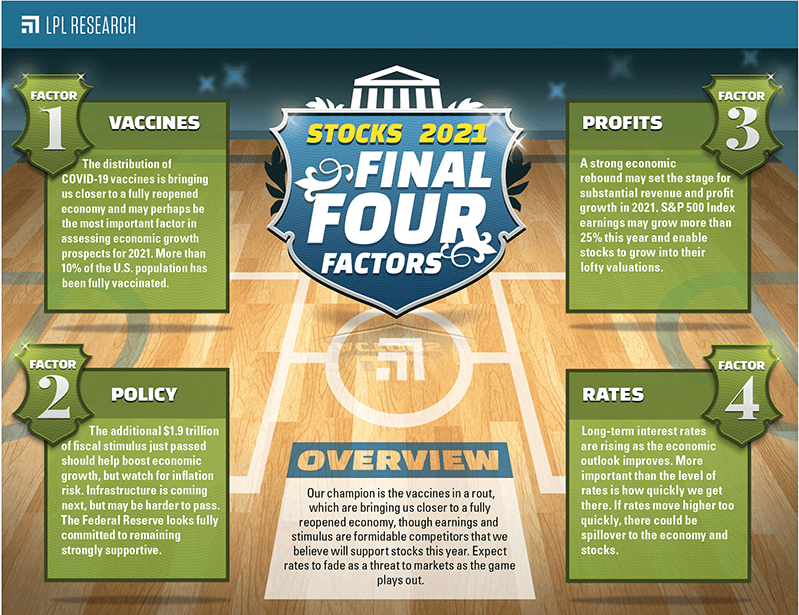

With the NCAA college basketball tournament getting underway this week, LPL Research is getting in the spirit with its own version of March Madness. Here we share our “Final Four Factors” for the stock market in 2021: Vaccines, Policy, Profits, and Rates. While we see several strong competitors in this field, we believe the likely winner of this tournament is clear, and it will push stocks higher over the balance of the year.

FACTOR #1: VACCINES

Perhaps the most important factor in assessing economic growth prospects

The distribution of COVID-19 vaccines is bringing us closer to a fully reopened economy and is likely the most important factor in assessing economic growth prospects for 2021.Their importance to the outlook for the US economy and financial markets cannot be overstated.

Since the approval of the first vaccine candidate in early December 2020, the United States has administered over 100 million doses and has fully vaccinated roughly 13% of the total population, according to data from Johns Hopkins. The current pace of over 2.4 million shots per day is expected to pick up soon as the Johnson & Johnson single-dose vaccine—granted emergency use approval on February 27—becomes more widely available. The vaccine is easier to store and transport

The vaccine rollout and ongoing containment measures have helped quell the winter surge in cases. New daily cases have fallen from a peak near 300,000 on January 8 to an average of around 50,000 last week. The number of people hospitalized with COVID-19 in the United States has also plummeted. And currently approved vaccines appear to be effective against current variants of COVID-19, helping quell the risk of another wave of infections.

Thanks in large part to the efficacy of the vaccines, we expect the economy to move closer to a full reopening over the next several months as the end of the pandemic approaches.

FACTOR #2: POLICY

Added stimulus provides a clear near-term benefit. But what about long-term risks?

President Biden signed a nearly $1.9 trillion stimulus bill into law on March 11, 2021. This latest stimulus package comes on the heels of approximately $3.4 trillion in stimulus passed by former President Trump in 2020, the last a $900 billion bill signed into law on December 27.

Markets generally cheer stimulus, at least in the short term, and we’ve seen a historic amount of debt-financed fiscal support in the past year. Markets are forward looking, suggesting much of the stimulus has likely largely been priced into markets. At the same time, stimulus helps protect against economic downside and could still contribute to an upside surprise in conjunction with vaccines.

The Federal Reserve (Fed) is also continuing to provide monetary stimulus, both by keeping its policy interest rate near zero and through its bond purchase program to help contain longer-term interest rates. The Fed has signaled that they will be cautious about raising rates, the most recent Fed policy committee projection putting the first rate hike of the economic cycle in 2023. Well before that, the Fed may start to signal growing comfort with the trajectory of the economy by easing off bond purchases, possibly as soon as this year.

While stimulus is likely to continue to support markets over the near term, the risks are longer term. A widely expected temporary rise in inflation would be manageable, but a structural change in inflation may roil markets. We believe the longer-term forces keeping inflation in check, such as demographics, globalization, and technology innovation, remain in play. High debt levels carry a financial cost, but the impact on growth is likely to be gradual over a long period of time.

Click here to read the rest of the report.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet.

Please read the full Outlook 2021: Powering Forward publication for additional description and disclosure.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

| Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value |