Stocks bounced back big time last week, on the heels of the worst week since late October. The usual suspects of strong earnings, fiscal and monetary policy, and better vaccine news all contributed. This week Ryan Detrick and Jeff Buchbinder put it all together, discussing why they are upgrading their views.

Tom Terrific Does It Again

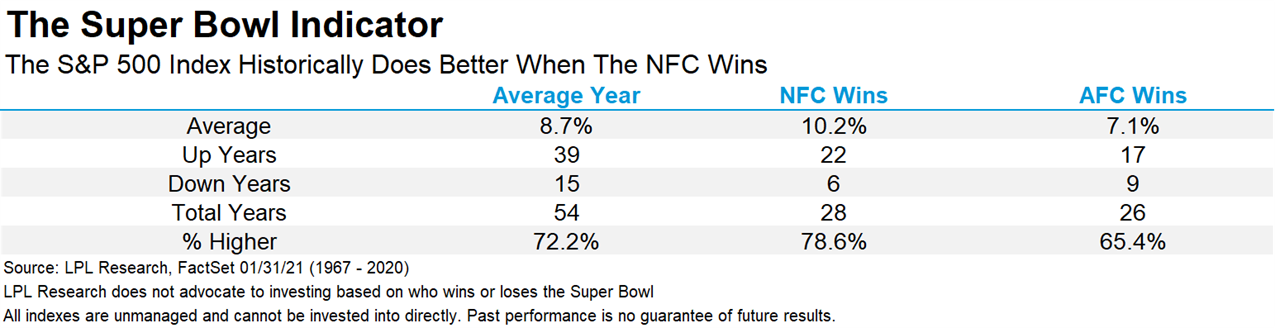

Tom Brady won his record 7th Super Bowl and although we don’t suggest ever investing on this, stocks have done better after an NFC team wins. Additionally, we note that stocks have done much better after Tom Brady wins the big game than when he loses. Of course, never invest on this, but it is that time of year and is a fun one to discuss.

Upgrade to our views

The resiliency of the US economy continues to exceed expectations. In light of this, we discuss why they raised their 2021 forecasts for GDP growth and S&P 500 Index earnings, while also increasing their year-end 2021 fair value target for the S&P 500 to a range of 4,050—4,100 based on a price-to-earnings ratio of roughly 21.

More good news

Incredibly, S&P 500 Index earnings are now expected to be positive in Q4, as more than 80% of companies have beaten estimates. Additionally, manufacturing and services data remain strong, but we did note that the employment backdrop is the one area that has stubbornly disappointed. Overall though, with more stimulus coming and more vaccinations, a strong economic recovery is under way.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth in the podcast may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. All indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All index data is from FactSet.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

This Research material was prepared by LPL Financial, LLC.

Member FINRA/SIPC