The S&P 500 is coming into month-end aboard an impressive 3% March rally, likely extending its winning streak to five straight months. Even more impressive is the broader market’s 10.0% first-quarter price gain, which includes 21 record highs as of March 27 (equating to roughly a new high every three trading days) and a maximum drawdown of only 1.7%. While these stats are impressive, they are also now in the rearview mirror. However, in today’s blog, we consider a few seasonal studies that suggest this rally could have more room to run.

April Showers Ahead?

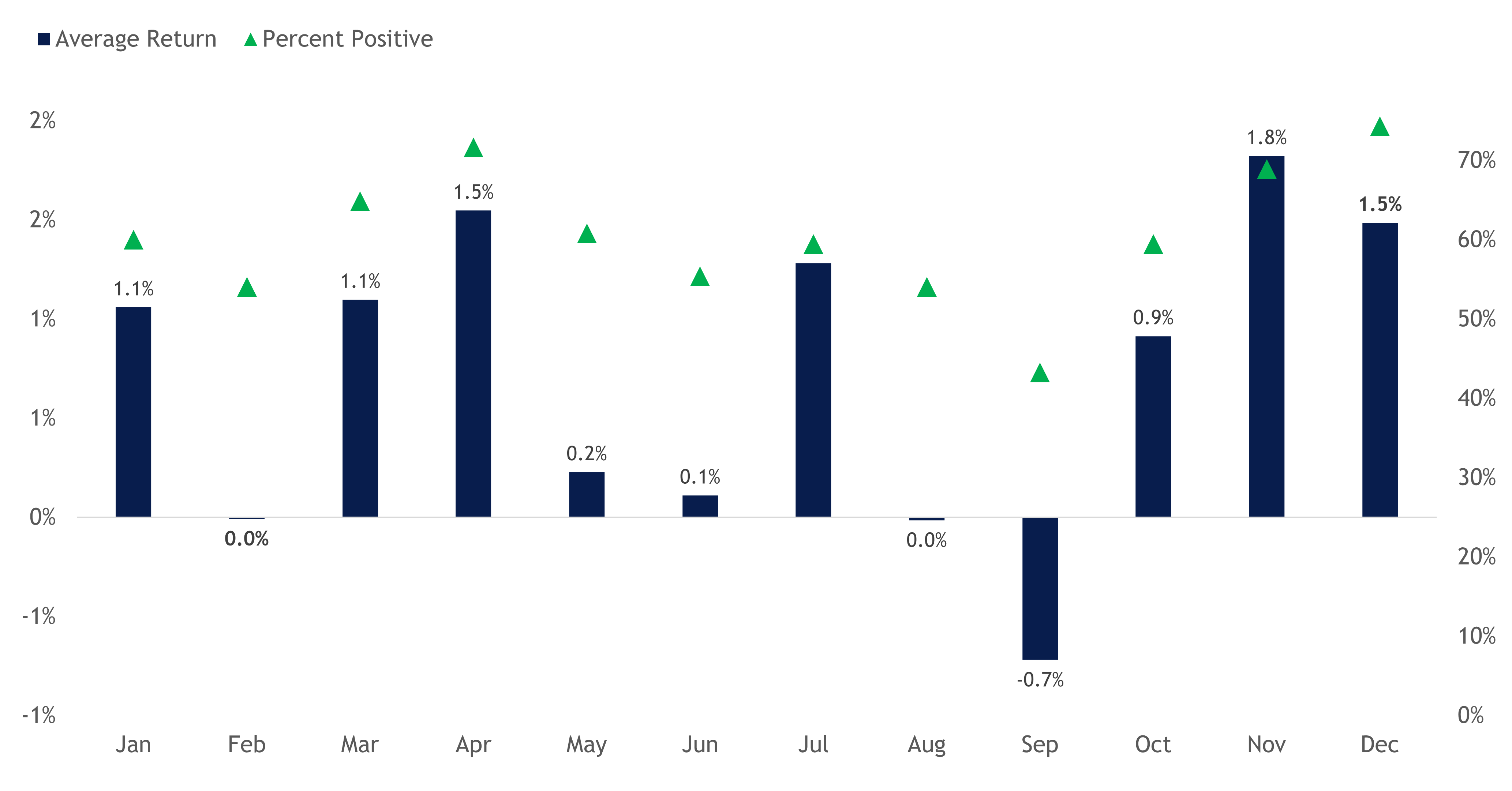

While April is often associated with rainy weather, it also is a time of growth that brings some green back to many parts of the U.S. landscape. For stocks, it can also be a good month for growth, as the S&P 500 has generated an average April return of 1.5% since 1950, with 72% of months finishing in the green. During an election year, the index has posted an average April return of 1.3% since 1952.

S&P 500 Monthly Seasonality (1950–YTD)

Source: LPL Research, Bloomberg 03/27/24

Disclosures: Past performance is no guarantee of future results. All indexes are unmanaged and can’t be invested in directly. The modern design of the S&P 500 stock index was first launched in 1957. Performance back to 1950 incorporates the performance of the predecessor index, the S&P 90.

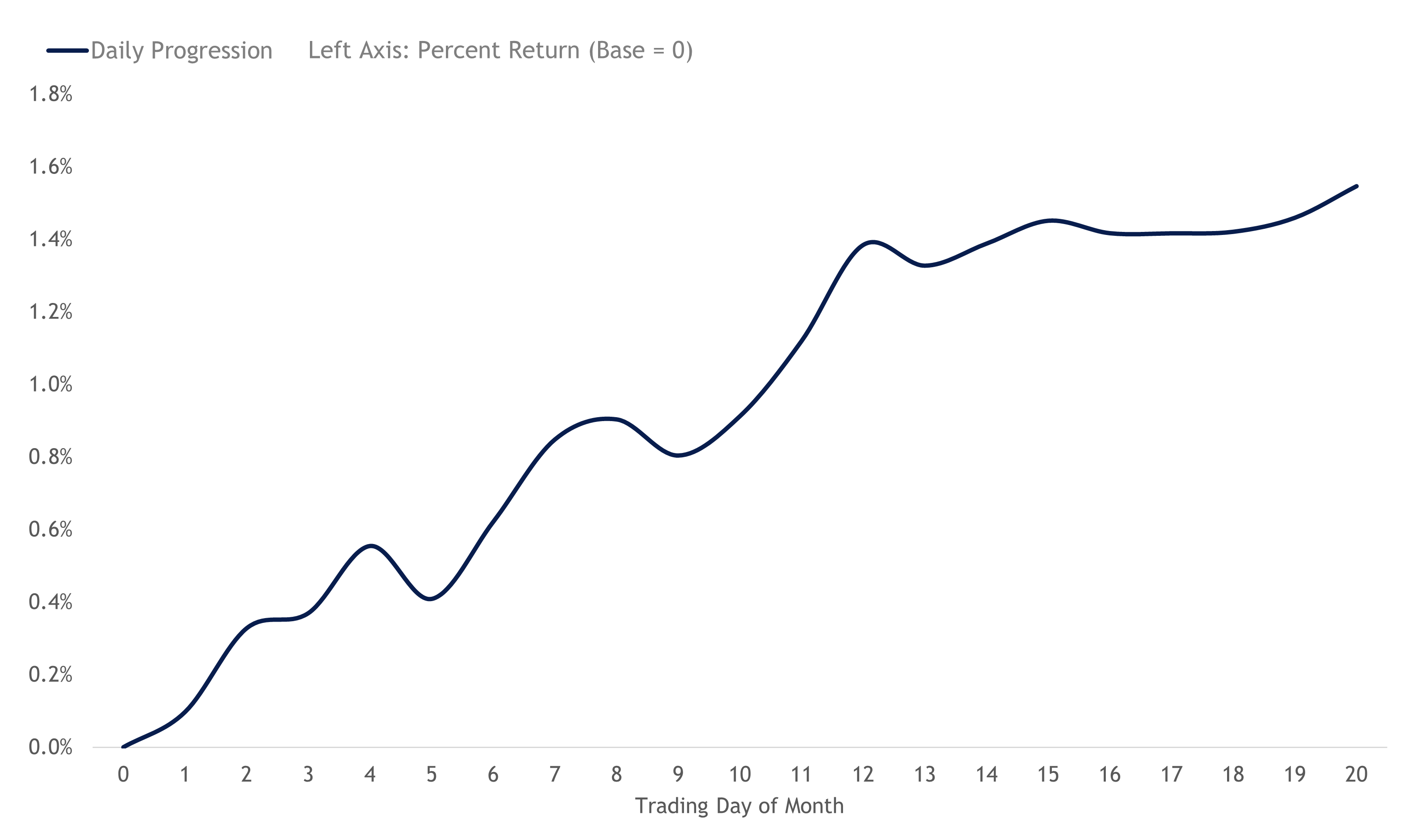

Gains in April are typically front-end loaded. Most of the 1.5% average monthly gain is generated during the first twelve trading days, with price progression tapering off into month-end.

S&P 500 April Progression (1950–2023)

Source: LPL Research, Bloomberg 03/27/24

Disclosures: Past performance is no guarantee of future results. All indexes are unmanaged and can’t be invested in directly. The modern design of the S&P 500 stock index was first launched in 1957. Performance back to 1950 incorporates the performance of the predecessor index, the S&P 90.

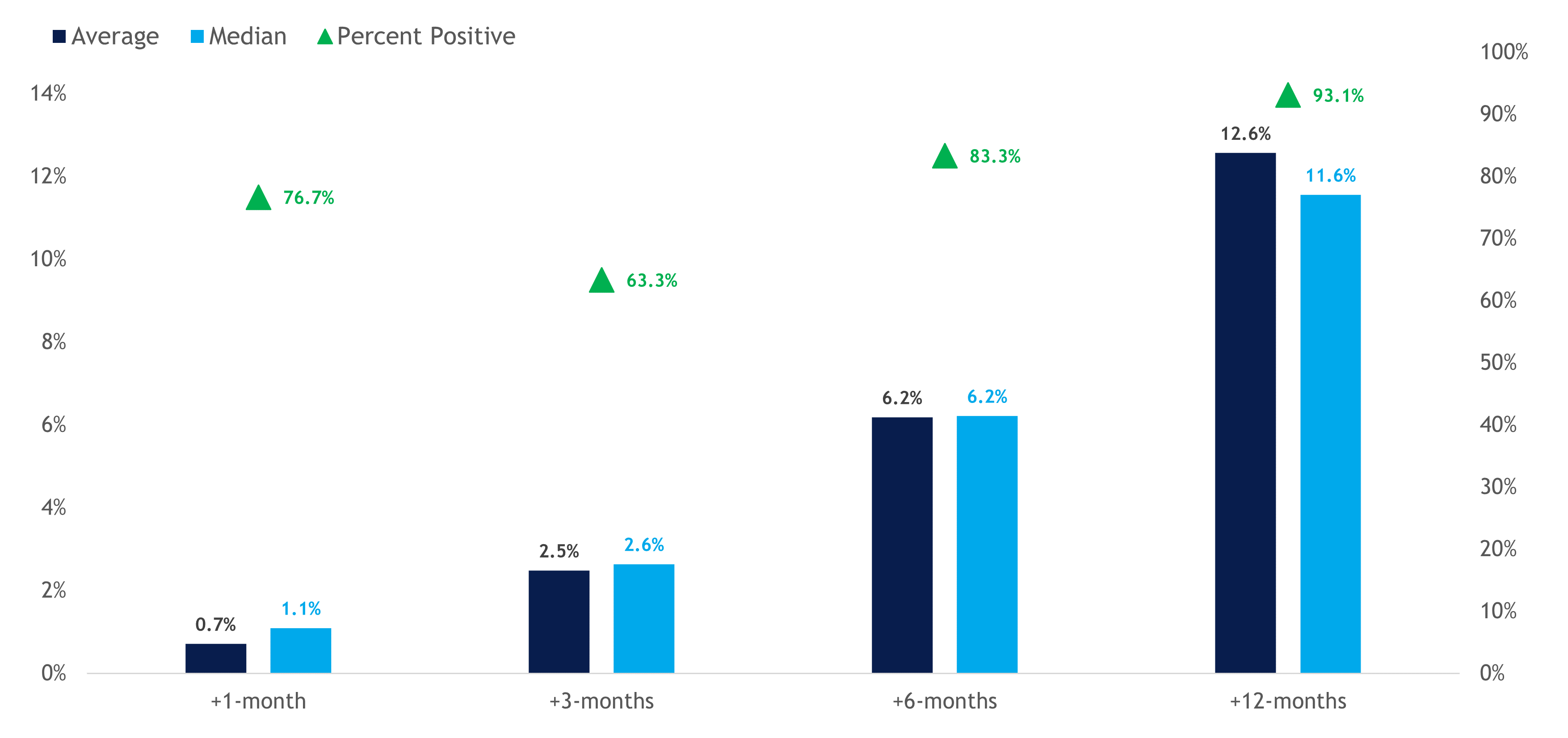

Momentum Begets Momentum

Barring a 3% decline today, the S&P 500 is set to post its fifth straight monthly gain. Winning streaks of this magnitude are not only rare but provide another positive sign for stocks. Since 1950, there have only been 30 other occurrences when the market rose for at least five consecutive months. Forward returns following these periods were widely positive, with average and median 12-month gains of around 12%. In addition, the S&P 500 traded higher twelve months later 93% of the time. For additional context, the average maximum drawdown during the 12-month period was 9.8%.

S&P 500 Performance Following a Five-Month Win Streak (1950–YTD)

Source: LPL Research, Bloomberg 03/27/24

Disclosures: Past performance is no guarantee of future results. All indexes are unmanaged and can’t be invested in directly. The modern design of the S&P 500 stock index was first launched in 1957. Performance back to 1950 incorporates the performance of the predecessor index, the S&P 90.

Summary

Stocks have had an impressive rally to start the year, shrugging off higher interest rates, recent hotter-than-expected inflation data, stretched valuations, and a notable reduction in expectations for Federal Reserve rate cuts. A resilient U.S. economy and the prospect of a soft landing have been the keys to keeping buyers engaged.

Mega-caps and artificial intelligence continue to steal most of the spotlight and overshadow a strong supporting cast of cyclical sectors that have become integral to the bull market story, and while momentum is overbought, it does not mean the rally is over. Seasonal trends alone suggest April could be another decent month for stocks, and looking out longer-term, comparable periods with strong momentum also imply this rally could have more room to run over the next 12 months.

LPL Research does not expect the path higher to be linear, and considers the current rate of change as unsustainable, but would also consider a pullback as healthy, providing an opportunity for overbought conditions to reset, fundamentals to catch up with price, to curtail any extreme bullish exuberance, and offer investors another entry point back into this bull market.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk.

Indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

This material was prepared by LPL Financial, LLC. All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

Unless otherwise stated LPL Financial and the third party persons and firms mentioned are not affiliates of each other and make no representation with respect to each other. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.

Asset Class Disclosures –

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

Bonds are subject to market and interest rate risk if sold prior to maturity.

Municipal bonds are subject and market and interest rate risk and potentially capital gains tax if sold prior to maturity. Interest income may be subject to the alternative minimum tax. Municipal bonds are federally tax-free but other state and local taxes may apply.

Preferred stock dividends are paid at the discretion of the issuing company. Preferred stocks are subject to interest rate and credit risk. They may be subject to a call features.

Alternative investments may not be suitable for all investors and involve special risks such as leveraging the investment, potential adverse market forces, regulatory changes and potentially illiquidity. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.

Mortgage backed securities are subject to credit, default, prepayment, extension, market and interest rate risk.

High yield/junk bonds (grade BB or below) are below investment grade securities, and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.

Precious metal investing involves greater fluctuation and potential for losses.

The fast price swings of commodities will result in significant volatility in an investor's holdings.

Securities and advisory services offered through LPL Financial, a registered investment advisor and broker-dealer. Member FINRA/SIPC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | Not Bank/Credit Union Guaranteed | May Lose Value